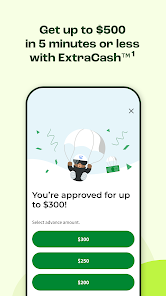

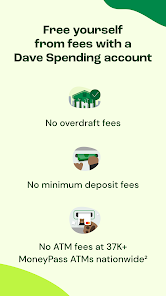

Dave - Banking & Cash Advance

-

Version

V3.50.0

File Size

200.94MB

Installs

10,000,000+

-

Content Rating

Rated for 3+

Screenshots

1. How much free space do I need on my device to install Dave - Banking & Cash Advance?

Make sure you have at least 200.94MB of available space for the app itself, plus an additional 100-500MB for updates, cache, and smooth performance once the game is installed.

2.Is it safe to download and install Dave - Banking & Cash Advance on my device?

Yes. Every version of Dave - Banking & Cash Advance provided by us is scanned and verified before being uploaded. This ensures the files are free from viruses or harmful code, so it's safe to download and install.

3. How much time will it take to finish downloading Dave - Banking & Cash Advance?

The app size is 200.94MB, and the time needed depends on your internet speed:

4G: around 30-100 MB/s

5G: around 170-400 MB/s

Wi-Fi: around 50-500 MB/s

4. What are the possible reasons my download or installation keeps failing?

Common causes include:

- Insufficient storage space

- Incompatible device or outdated Android version

- Weak or unstable internet connection

- Interrupted download session

5. What's the difference between APK and XAPK files, and how can I download them properly?

There are two main file types you might encounter:

- APK: This is the standard Android installation package. It's best for simple apps that don't need extra resource files. You can download and install it directly.

- XAPK: This version contains both the APK and additional data files (like OBB resources) required for larger apps or games. Use an installer to handle XAPK files automatically.

6. How do I install this app after downloading it?

If you downloaded the app outside the official Google Play Store, the installation process on Android devices might seem a bit tricky at first.

But don't worry — we've got you covered! To make things easier, we've prepared a step-by-step installation guide complete with screenshots. Just follow the instructions provided on our website How to install APK/XAPK files on Android, and you'll be able to set up the app in no time.

Previous Apk Versions

Recommended Apps

![]()

PayPal Business

PayPal Mobile4![]()

Collage Maker Pro - CollageLab

Pic Collage Maker & Photo Editor4.6![]()

HD Camera

KX Camera Team4.3![]()

Music ringtones for phone

Ringtones for Phone4.6![]()

Text Message Sounds

Crystal Clear Ringtones4.2![]()

Samsung Link (Terminated)

Samsung Electronics Co., Ltd.4.2![]()

Skull Color, Color by Number

Excellent Coloring Pages4.8![]()

Insight Timer - Meditation App

Insight Network Inc4.8![]()

VIP Access

Symantec VIP3.8![]()

Messenger - SMS Messages

AZ Mobile Software3.9![]()

Zillow: Homes For Sale & Rent

Zillow4.7![]()

Photo Collage Maker

Scoompa4.7![]()

Name Meanings with Impact

Alif Innovative Solution3.7![]()

Sync for iCloud Email

io.mt4.5![]()

Hair Clipper Prank

Cüneyt AYYILDIZ3.9

Hot Apps

-

![]()

Fubo: Watch Live TV & Sports

fuboTV1.7 -

![]()

Venmo

PayPal, Inc.4.2 -

![]()

MyChart

Epic Systems Corporation4.6 -

![]()

Bird — Ride Electric

Bird Rides, Inc.4.7 -

![]()

Snapchat

Snap Inc4.1 -

![]()

T-Mobile Internet

T-Mobile USA4 -

![]()

Peacock TV: Stream TV & Movies

Peacock TV LLC4.5 -

![]()

TracFone My Account

TracFone Wireless, Inc.3.6 -

![]()

Gmail

Google LLC4.3 -

![]()

Walgreens

Walgreen Co.4.7 -

![]()

Police Scanner - Live Radio

Police Scanner, Scanner Live Radio App4.8 -

![]()

UnitedHealthcare

UNITED HEALTHCARE SERVICES, INC.4.4 -

![]()

Affirm: Buy now, pay over time

Affirm, Inc4.7 -

![]()

Pandora - Music & Podcasts

Pandora4.1 -

![]()

Klover - Instant Cash Advance

Klover Holdings4.1 -

![]()

eBay: Online Shopping Deals

eBay Mobile4.6 -

![]()

Link to Windows

Microsoft Corporation4.2 -

![]()

Roku Smart Home

Roku, Inc. & its affiliates4.4 -

![]()

TouchTunes: Live Bar JukeBox

Touchtunes Interactive Networks3.2 -

![]()

TikTok

TikTok Pte. Ltd.4.4 -

![]()

DealDash - Bid & Save Auctions

DealDash.com3.9 -

![]()

Ticketmaster AU Event Tickets

Ticketmaster L.L.C.2.8 -

![]()

Green Dot - Mobile Banking

Green Dot4 -

![]()

Waze Navigation & Live Traffic

Waze3.9 -

![]()

Subway®

SUBWAY Restaurants4.5 -

![]()

Direct Express®

i2c Inc.4.3 -

![]()

Facebook

Meta Platforms, Inc.4 -

![]()

Dave - Banking & Cash Advance

Dave, Inc4.3 -

![]()

myAir™ by ResMed

ResMed3 -

![]()

PayPal - Send, Shop, Manage

PayPal Mobile4.3

Disclaimer

1.Appinfocenter does not represent any developer, nor is it the developer of any App or game.

2.Appinfocenter provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3.All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4. Appinfocenter abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy .